Africa Digital transformation 2020-2030 - short term, Long-term implementation Scenarios, an alternative view

Executive Summary

Sam Atuhamya is a young, energetic casual laborer on a small four acre banana

plantation just 25km outside of Kampala, the capital city of Uganda. He earns

about USD40 a month. Sam has a small 2G phone he uses to communicate regularly

with his family, a wife and 2 school going children, about 400km away in the

south west of Uganda. They have two lactating cows and regularly earn a small

monthly income, about USD30 to supplement Sam's’ monthly income.

The family therefore

earns about USD70 monthly part of which is used to pay school fees for the

children.

Sam has no

electricity at his house, even though the grid is about 4km away from his

workstation. So Sam has to carry his phone, always walking past the overhead

electricity lines to a nearby trading centre to charge. It is a similar

situation for the Wife, with the Grid several Kilometers away.

Sam’s household

represents the broad spectrum of families in Africa, from Madagascar, Nigeria,

South Sudan or Kenya, low income generating, largely living in rural areas with

scanty, if any, access to utilities like electricity, water and

telecommunications.

It represents the

focus of the broadband and digital transformation agenda of the World Bank Moonshot for Africa Report 2019,

Dead spots or areas outside of broadband coverage – near towns or inland in

ultra rural areas, with a population whose revenue potential isn’t attractive

to established telecom operators to fast track investment.

Objective

The key objective of this paper is to look at ways of speeding up

implementation of broadband roll-outs with the forecast investment expenditure

to achieve the World Bank 2021 and 2030 digital transformation milestones.

Some Definitions

To help us understand the end game towards

World Banks’ digitalization agenda, we extra some definitions for context in

the table below;

|

|

|

|

Broadband |

Defined as a download

rate of 3mbps(2021 target) and 10mbps(2030 target) over a technology neutral

connection |

|

Unserved, Unconnected Areas |

Areas with no network coverage, with no incentive for

traditional telco investment, or areas with traditional 2G and require 3G /4G

or equivalent technology upgrade to support broadband connections |

|

Budget (2021 target) |

USD9bn investment

forecast to Double broadband connections from 2016 numbers, and 220m new

users online |

|

Budget (2030 target) |

USD100bn investment

forecast to connect 1.1billion users online, with 250,000KM of fibre &

400,000 4G/5G and other technology

Base stations |

|

|

|

A snapshot of Africa Telco Roll-outs

Telecom

companies will always follow the money. This means that their business plans,

their investments will be tied to areas with proven, demonstrable economic

activity and sizeable population density. You will therefore always find fiber

or transmission roll-outs following highways, site roll-outs targeting areas

with sizeable population numbers fitting into their Average Revenue per user

(ARPU) agenda.

It’s

therefore inevitable that some areas inland are locked out of Broadband network

coverage. For digitization to happen in such areas, in line with WB 2030

agenda, Development Partners, country regulatory bodies, Integration Partners

must work together to find innovative, sustainable and cost-effective broadband

solutions to fill this Gap.

Community Set up

Communities in Africa

will vary in size, but in order to address the Broadband gap, it is important

to understand their various set-ups to provide information on population

density and possible economic activities in those areas.

In Uganda for example,

you have the smallest administrative unit, the Local Council 1(LC1) with a

population of about 250 -1000 People

In Madagascar you

have the Communes made up of several Fokontany as the smallest administrative

unit, with varying population density based on proximity to the Ocean and/or

inland near small towns/communities.

For purposes of this

paper we will assume a rural population of anywhere between 50-300 people,

under the knowledge that Telco players would in any case have economic

motivation to invest in areas with populations exceeding these numbers.

The Electricity Conundrum

Most

rural communities in Africa lack basic utilities like water and electricity. In

order for the Broadband value chain to be complete, we must address the issue

of electricity. This is vital in charging phones and powering base Stations,

microwave or satellite links that make up the broadband network.

The cost

of extending grid distribution lines is prohibitive (cost

per km anywhere between 20-30,000USD in Uganda)

and in fact in some cases the rural area just provides a transit/Wayleaves

access route to the next town, without necessarily being served.

In places

like the South of Madagascar, not only is the road network, crucial in speeding

up broadband installations, especially impassable in Rainy seasons, you will

find that outside of Fort Dauphan (Tolagnaro) towards Amboasary, Ambovombe,

Tsihombe, and Beloha, the sign of electricity is only found within the

community town, being run on diesel generators with no sign of Gridlines in

between, even though along the route are several small rural communities.

Indeed,

2018 data from one operator there shows just over 50% of sites running on diesel generators, which means high

Operational expenditure, translating into higher Broadband prices.

Solution?

We can circumvent this challenge by taking

advantage of our natural energy endowment by harnessing the power of Solar

Energy.

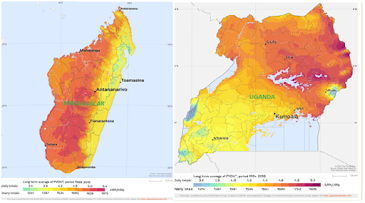

Solar Photovoltaic (PV) intensity or

irradiation in specifically Sub-Saharan Africa (SSA) is such that there are

enough hours of sunshine, an average of 4-5Hours, to generate enough energy to

power broadband sites and community internet access centers. See sample figure

below;

Luckily, the cost of solar equipment today is also

cheaper, thanks to regulatory and Government initiatives like some tax

exemptions e.g. here in Uganda.

Therefore, in understanding precise power

requirements of broadband base stations, we can size, cost and implement an

effective and practical solar power solution that delivers affordable, quality

broadband.

So whats the average power requirement

for a remote rural site?

The

assumption is that we want to cover remote rural areas, off-grid, sparsely

populated and out of reach for traditional telecoms.

We must

dimension a solution that balances Cost, Coverage & quality requirements,

meets today’s expectation (3mbps baseline) but also provide a smooth transition

into future technology upgrades. The latter is achieved by using Software

Defined Radio (SDR) Units that can be software upgradable without change of

Hardware.

The table below shows power consumption by BTSes from some leading equipment vendors

|

Vendor |

Technology |

Configuration |

Typical Power Consumption(W) |

Microwave(W) |

Site Load(W) |

|

Nokia(flexiModule BTS) |

GSM +WCDMA |

S6+U_4 |

790 |

100 |

890 |

|

|

|

|

|

|

|

|

ZTE(ZXSDR BS8906) |

GSM +WCDMA |

G_S4+U_S1, DC |

465 |

100 |

565 |

|

|

GSM +WCDMA |

G_S444+U_S111 |

815 |

100 |

915 |

Table 1 shows the average power consumption for a loaded BTS, including microwave or VSAT transmission equipment.

For the remote

rural site, consumption will be way much lower than in the above table because

the configuration will be smaller say 1 transceiver

unit (TRX) and 1 UMTS carrier. For this paper, we will assume a realistic

maximum power Consumption of 400W. With the Solution set up and Maintenance

free, this adds to reducing the end cost of broadband bundles for the users,

ultimately leading to more connections.

Deployment Scenarios

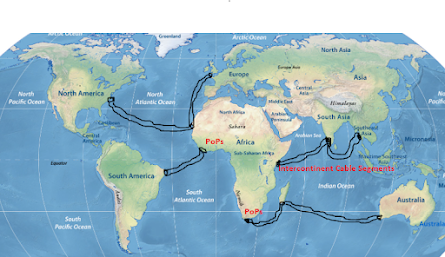

Connectivity

of Base stations in rural areas to the super information highways of the

Internet can only be possible with a baseline of a solid transmission

backbone. The ultimate end goal is

therefore to have fibre connectivity as near to remote rural areas as possible.

However for the case of Sub-Saharan Africa, the nearest point of Presence for

fibre is realistically far off, in some cases more than the 25km mentioned in

the moonlight light report. Therefore it’s important to devise alternative means

of backhauling the rural site traffic. Most deployment scenarios will follow a

monolithic and/or distributed architecture framework as shown below;

The Ideal Power System

A standalone

solar system, with a 24Hour autonomy and as seen in Figure 2 below completes

the site configuration, with the number/quantity of panels, battery and charge

controllers dependent solely on site load.

Rural Tower Design and Site Lay-out

Normal

telecom towers take a month or more to erect and commission depending on

factors such as weight/ tower loading, civil works completion, route/road

access etc. For remote rural sites, It is necessary to dimension a tower that’s

low cost, can be installed and commissioned within a day or two to facilitate fast

turnaround times for broadband coverage and online access by rural population.

In General, an ideal tower for remote rural broadband coverage should be anywhere between 10-20m, closer to the population, with antennae that meet minimum electromagnetic radiation safety standards as shown in the Figure below;

Security

for the remote rural sites to avoid vandalism

and theft can be handled at a community level, which adds to reduction in

overhead costs.

2G, 3G,

4G access technologies assume a lion of sight environment to provide adequate

broadband coverage. Alongside this is the need to limit interference to

acceptable levels. Therefore cell radius or coverage area will in most cases be

limited to 100’s of meters to a few kilometers. With this reality in mind, the

number of base stations required will be higher which increases the cumulative

cost of deployment. This hence presents a case for looking at alternative

technology deployments to achieve the same end goal.

TV White Space Technology (TVWS)

This is a

new technology that takes advantage of idle spectrum, the guard bands, within

the UHF and VHF bands for Television broadcast to deliver broadband

connectivity.

It works very well in non-line of sight

conditions and its coverage area can therefore stretch to up to 10km, with

distances of up to 50km in Line of sight conditions and therefore fewer BTSes. The

Gen3 Rural Connect Base Station from

Carlson Wireless provides these and other features; with plug and play installation

times meaning broadband can be delivered to schools, health centres, in remote

areas quicker.

Trials of this technology to deliver broadband

have been conducted by Carlson Wireless & Neul, with support by ICASA successfully in Cape Town South Africa, with Download

speeds up to 12Mbps and upload speeds of up to 4Mbps over a 6month trial period

attained.

It’s

therefore prudent that for the broadband agenda 2030 to be achieved TVWS must

be considered for point to point and point to multipoint roll-out in various

communities.

Wi-Fi

This is

another alternative technology, based on the IEEE802.11 (xx) Standards that can

provide broadband in the unlicensed 2.4GHz and 5GHz bands with coverage radius

upwards of a kilometer. Advancements in the IEEE802.11xx technology standards

mean carrier grade Wi-Fi can provide stable connections for some rural

deployments.

A Quantitative analysis of forecast

network deployments and what it means for Africa

The World Bank moonlight report

forecasts deployment of four hundred thousand (400,000) 4G and 5G base stations

as well as two hundred and Fifty thousand (250000) Kilometers of Fiber

Based on

the above figures, a linear analysis of what this means in the context of

Africa is shown in the table below, where we have assumed a ratio of 5%:95%

investment allocation over the 11 year cycle (2019-2030) respectively between

Northern Africa and Sub-Saharan Africa. This assumption is based on the facts

below;

- a) Northern Africa broadband coverage is

higher compared to that in Sub-Saharan Africa, with only about 2% out of

broadband network coverage according to the moonlight report

- b) There are fewer countries, only 5, in northern Africa as compared to Sub-Saharan Africa

|

Total Forecast Investment |

||

|

Fibre(KM) |

250000 |

|

|

Base stations |

400000 |

|

|

Region |

Northern Africa |

SubSaharan Africa |

|

Countries |

5 |

49 |

|

% Investment allocations |

5% |

95% |

|

Categorized Investment breakdown(Regions) |

||

|

Total Fibre(Km) |

12500 |

237500 |

|

Total Base station |

20000 |

380000 |

|

Per Country Deployment Forecast |

||

|

Fibre(Km) |

2500 |

4847 |

|

Base stations |

4000 |

7755 |

|

Annual Deployment Forecast(Per Country) |

||

|

Fibre(Km) |

227 |

441 |

|

Base stations(BST) |

364 |

705 |

Table 2

shows that to achieve the 2021 and 2030 targets,

·

Each

country in Northern Africa needs to deploy, consistently, 227KM of Fiber

annually (19KM monthly),and 364 BST annually( 30 BST monthly)

·

Each

country in Sub-Saharan Africa needs to deploy, consistently, 441KM of Fiber

annually(about 37KM monthly), and 705 BST annually or( about 59 BST monthly)

From this

information we can deduce that applying Country specific coefficients will

determine how many more (or less) allocations in terms of length of fiber or

number and category of base stations per country per Year. Also at a country

level, it is necessary to use a targeted approach in expanding broadband by

looking to cover first areas with significant economic potential.

This

linear analysis clearly shows that the length of fiber seems small compared to

the number of users forecast to be online by 2030. To achieve true broadband,

we argue that there needs to be more investment in Fibre / transmission network

footprint down to community level.

But how long does it take to do a

Kilometer of Fiber?

Execution

timelines for deploying fiber underground, overhead or in a mixed configuration

is a critical determinant in achieving the 2021/2030 broadband Coverage agenda

as it provides the baseline for interconnecting base stations to the internet

to facilitate broadband access. The major activities for underground fiber

deployment, as an example are below;

|

No. |

Field Teams |

Team Composition |

Fibre Activities |

Day 1 |

Day 2 |

Day 3 |

|

1 |

Team 1 |

100 |

Route Trenching |

|

|

|

|

2 |

Team 1 |

Duct Installation |

|

|

|

|

|

3 |

Team 2 |

20 |

Backfilling & Reinstatements |

|

|

|

|

4 |

Team 2 |

Compaction |

|

|

|

|

|

5 |

Team 3 |

10 |

Manhole Installation |

|

|

|

|

6 |

Team 4 |

10 |

Fibre Hauling in Duct |

|

|

|

|

7 |

Team 5 |

Fibre Splicing & Test |

|

|

|

An aggressive activity schedule to deploy 1KM of

fiber includes mainly 7 activities each following the other, with an average

daily output of 10m per rigour in the

trenching team. We also assume that prior activities like pre-casting of Manholes, procurement of

fiber & ducts happened previously. Further,

that there are fewer reinstatements due to tarmac

demolition as the physical routes are towards rural areas and mainly earth/loam

soil.

We can conclude from the above that,

- ·

A minimum of three (3) days and 140 rigors

in the field are required to complete a 1KM fibre stretch end to end.

- ·

Multiple teams and multiple

installers for each activity are needed to fast track implementation and

realize the 2021/2030 broadband agenda by doing most of the activities in

parallel

- ·

Technology must be used to fast

track deployments

Synergies with other Public Infrastructure projects, and the budget saving

Governments normally engage in big

infrastructure projects, with funding from development partners like the World

Bank. In Africa it’s mainly in areas of;

a)

Rural electrification projects(REP)

b)

Road construction/ Highway projects(RCHP)

We can extend fiber closer to the communities

and fast track the 2030 broadband agenda by including overhead fiber runs (in

case of REP) and Utility ducts and fiber (in case of RCHP) within the project

scope as opposed to doing them independently.

|

Rural Electrification Agency(REA) |

Medium Voltage Lines (Km) |

Low Voltage Lines(KM) |

Total(KM) |

Source |

|

|

10,000 |

7,000 |

17000 |

REA Website |

|

Uganda National Roads Authority(UNRA) |

Paved Road(KM) |

Gravel Road(KM) |

|

|

|

|

5,000 |

20,000 |

25000 |

Unverified |

|

|

|

Total |

42,000.00 |

|

Network Opex Vs High Availability

|

Item |

Budget 2021($bn) |

% of 2021 Allocation |

Budget 2030($bn) |

% of 2030 Allocation |

|

Target Broadband Users(millions) |

220 |

1100 |

||

|

Focus Area |

|

|||

|

ICT skills & Dev't |

1.7 |

4.05 |

18 |

17.5 |

|

Policy & Regulation |

0.5 |

1.19 |

2.4 |

2.33 |

|

Network Operations & Maintenance |

2 |

4.76 |

53 |

51.5 |

|

Infrastructure Capex |

5 |

11.90 |

29.5 |

28.67 |

|

Total |

9.2 |

|

102.9 |

|

|

Cost Per Online User connection |

42 |

93.5 |

||

The above

table shows budget allocations as forecast from the World Bank moonlight report

to achieve the broadband milestones. What seems to stand out is the high

operational cost (opex) allocation at 51.5%, perhaps out of the need to run off

diesel generators to power broadband sites, staff salaries and the like.

To

achieve high availability and significant reduction in maintenance costs from

site outages and the like, we argue that an increased investment in the site

Solar power systems and transmission/fiber networks redundancy will go a long

way in achieving this milestone.

By

increasing days of autonomy and number of storage batteries per remote rural site,

and an increased investment in self healing/redundant fibre and/or transmission

network rings at targeted aggregation and access network levels, we

automatically increase site reliability and availability. Several scenarios on

how to achieve both physical/route and logical redundancy are available but

outside scope of this paper.

As well,

as noted previously above, we need to increase fiber footprint closer to

communities, in a range that accommodates high speed, small aperture,

short-haul last mile microwave connections to backhaul traffic to nearest fibre

point of presence and guarantee user end to end broadband speeds as defined by

the moonlight report.

The

budget for this investment can be a reallocation from the current opex budget, a

reduction by say 10% and this reassigned into the Infrastructure capex budget

for the same period. The outlook changes as displayed in the Table Below;

|

Item |

Budget 2021($bn) |

% of 2021 |

Budget 2030($bn) |

% of 2030 |

|

Target Broadband Users(millions) |

220 |

1100 |

||

|

Focus Area |

|

|||

|

ICT skills & Dev't |

1.7 |

18.48 |

18 |

17.49 |

|

Policy & Regulation |

0.5 |

5.43 |

2.4 |

2.33 |

|

Network Operations & Maintenance |

2 |

21.74 |

42.72 |

41.51 |

|

Infrastructure Capex |

5 |

54.35 |

39.78 |

38.67 |

|

Total Budget Forecasts |

9.2 |

|

102.9 |

|

A monthly

bundle of 125 voice minutes of use and 1GB of internet data, including Over the

Top (OTT) Tax(in the case of Uganda), costs about Uganda Shillings 10,000 on

the MTN Uganda network. This represents about 6.8% of Sams’ monthly salary.

This is still higher than the recommended 2% or less by the Broadband

commission in the moonlight report.

In

Madagascar, a monthly voice bundle, with 3hours 45minutes costs 10,000Ariary

and a 2Giga bundle costs 30000 Ariary, a monthly total of 40,000Ariary on the Orange

network. There is no equivalent 1G bundle to compare. These price plans are even

more expensive than in Uganda.

Therefore,

in this digitization agenda, Regulatory bodies need to enforce and industry

players implement special, innovative rural-based broadband price plans with In-bundle rates that attract, and not

deter users in this space. For the same user experience, Sams’ Wife should be

able to pay far less than a normal broadband subscriber in an uptown neighborhood.

Industry

players can implement these specific price plans by using location based

services feature, that tags service and charging plans to a location and is now

available in most core network deployments for 3G and 4G networks of leading

vendors. Also, deployment of such would be similar to say night shift bundles

offered at a cheap in-bundle rate to keep the network active with users online

say after midnight.

But more

importantly, prohibitive regulatory policies, like introduction of Tax on over

the Top Services, like is the case in Uganda, and the recent passing of new

licensing regimes that ideally constrain smaller players in investing

regionally(via exorbitant licence fees etc) makes rural business models commercially

unsustainable in the face of dominant industry market players.

Comments

Post a Comment