Africa is the next growth frontier for major investments in Infrastructure, in Agriculture and so many other sectors. But as Technology evolves towards cloud and data centre economics, and the race for 5G connectivity intensifies - there is still 750M unconnected subscribers, with the vast number, 300M in Subsaharan Africa and 220M South Asia according to the GSMA State Of mobile Internet connectivity Report 2019. The root cause is that there is no justifiable business case for telcos to deploy coverage infrastructure, especially since their investors require high returns in the mid to longterm.

One of the solutions to this conundrum lies elsewhere - enter Online companies

Online companies can be defined as those that conduct their businesses online by using the power of the internet. They can be termed as over the Top(OTT) companies. Some Examples for context are Google, Netflix, Alibaba, Zoom, Microsoft and so on.

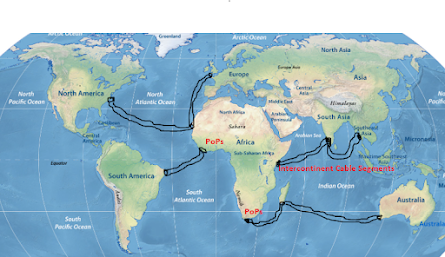

These companies make their money largely off already connected broadband subscribers. It is the Telecom companies though that make huge capital investments in telecommunication base stations, fibre optic networks, Spectrum Licence Acquisition, device partnerships etc, to create and maintain a broadband ecosystem necessary for online business. It is these same subscribers that online companies target. A 2019 statista.com snapshot report on revenue made by just six(6) of the leading online companies, as seen below means they need to participate even more in solving the rural connectivity conundrum, in the end contributing more towards digital inclusion in the unserved and underserved communities.

Online Companies can contribute towards digital inclusion by adopting the approaches below;

1) Pool Resources under a Rural investment Fund

Create a Special purpose vehicle Company(SPV) where all online companies can contribute a small percentage, say 0.5% of their revenue, over a 5year cycle towards broadband inclusion in the unserved rural areas. Individual companies (facebook, Google) have started these connectivity initiatives in Silos but with pooled resources there would be definite economies of Scale, competitive pricing for Telecom infrastructure and therefore better/affordable internet products for the rural folk.

The SPV would take away the projects' responsibilities so that the online companies continue to focus just on their core businesses.

An illustrative quantitative outlook for new online subscriptions based on the 0.5% allocation assumption, with 75% funds committed towards broadband infrastructure year on year is shown below;

From the table above we can see that an annual $3bn capital outlay from online companies revenue can lead to 72 million subscriptions over a 5year cycle, reducing the coverage Gap by about 24%.

2) Partner with Telcos and infrastructure providers.

With their experience in roll-out this speeds up broadband implementation and getting more of the 300m unconnected subcribers online quicker.

Telcos would offer affordable rural broadband priceplans that encourage adoption, since significant capex comes from the Rural fund.

Note: Any broadband infrastructure implementation is assumed to be of 3G speeds as a minimum.

3) Working with Sector Regulators

Channel a small %, up to 10% of the fund for regulatory bodies to facilitate favourable regulatory policy frameworks, and unlock spectrum for alternative, affordable broadband technologies e.g WiFi, TVWS etc

4) Use solar Green solutions for Site infrastructure

Besides the obvious contribution to reduction in carbon emissions, Solar Green solutions are almost maintenance free, therefore opex is very miniscule.

These solutions can also double as phone charging points in some rural communities

5) Address Accessibility and Affordability challenges

Work with established phone manufacturers to avail cheap but feature rich smartphones in the USD20-40 range while committing to bulk purchases using the Rural Investment Fund.

Since its a given that rural folk may not do an outright purchase, avail these phones to those with mobile money accounts or traceable bank Accounts under a time bound credit payment model.

Over a 5year cycle, with a 15% year on year allocation from the investment fund, we can get a minimum of 55million devices for subscribers, while the credit recovery under the staggered payment model caters for the deficit.

Benefits of this approach are several, some of which include the following;

a) Preferential treatment for Online companies traffic via premium Quality of Service flows and advertisement rights. this is simply because of their capital contributions towards addressing the coverage and accessibility gap.

b) New online subscriptions mean Widening the Tax base via value add and other taxes for the emerging economies. This would go a long way in deterring the clamor by some governments in introducing digital service taxes, like is soon to happen in Uganda, as a follow up of the social media Tax, commonly known as OTT tax.

see https://www.afritechpost.com/uganda-government-announces-plans-to-introduce-a-digital-service-tax/

c) There are more urban cities and organized Real Estate settlements coming into play due to population explosion, a young population and a growing middle class in Africa therefore more opportunities for mid-long term online subscriptions.

Comments

Post a Comment